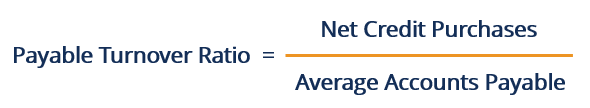

Net Credit Purchases ÷ Average Accounts Payable (AAP) = APTR In a nutshell, your AP turnover ratio measures short-term liquidity, tied directly to another important metric, days payable outstanding (DPO). Finding a way to keep sufficient cash on hand to support business goals while building strong supplier relationships requires a strategic approach for maintaining a healthy accounts payable turnover ratio. Why a Healthy Accounts Payable Turnover Ratio Mattersįor businesses big and small, cash flow and vendor relationship management are two business critical concerns. With the right tools and techniques, taking the time to fine-tune this ratio to protect your business operations and relationships is easier than you might think. Like its complement, the accounts receivable turnover ratio, the accounts payable turnover ratio is one of the most important financial ratios companies use to evaluate their near- and long-term success in meeting both their obligations and goals.

But that’s only the beginning it also directly affects the health of your relationships with suppliers, and your company’s overall ability to compete, grow, and innovate while still paying the bills. This is not a high turnover ratio, but it should be compared to others in Bob’s industry.Whether you call it the accounts payable turnover ratio, the payable turnover ratio, AP turnover ratio, or creditors’ turnover ratio, the number of times you pay your creditors in a given accounting period (measured in number of days) can have a significant impact on short-term liquidity (i.e., cash flow). This means that Bob pays his vendors back on average once every six months of twice a year. Based on this formula Bob’s turnover ratio is 1.97.

#ACCOUNTS PAYABLE TURNOVER RATIO PLUS#

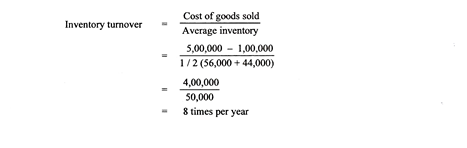

Here is how Bob’s vendors would calculate his payable turnover ratio:Īs you can see, Bob’s average accounts payable for the year was $506,500 (beginning plus ending divided by 2). According to Bob’s balance sheet, his beginning accounts payable was $55,000 and his ending accounts payable was $958,000. During the current year Bob purchased $1,000,000 worth of construction materials from his vendors. This ratio is best used to compare similar companies in the same industry.īob’s Building Suppliers buys constructions equipment and materials from wholesalers and resells this inventory to the general public in its retail store. Every industry has a slightly different standard. A high turnover ratio can be used to negotiate favorable credit terms in the future.Īs with all ratios, the accounts payable turnover is specific to different industries. It also implies that new vendors will get paid back quickly. As with most liquidity ratios, a higher ratio is almost always more favorable than a lower ratio.Ī higher ratio shows suppliers and creditors that the company pays its bills frequently and regularly. Since the accounts payable turnover ratio indicates how quickly a company pays off its vendors, it is used by supplies and creditors to help decide whether or not to grant credit to a business. To find the average accounts payable, simply add the beginning and ending accounts payable together and divide by two. The ending balance might be representative of the total year, so an average is used. The average payables is used because accounts payable can vary throughout the year. Most companies will have a record of supplier purchases, so this calculation may not need to be made.

Instead, total purchases will have to be calculated by adding the ending inventory to the cost of goods sold and subtracting the beginning inventory. The total purchases number is usually not readily available on any general purpose financial statement. The accounts payable turnover formula is calculated by dividing the total purchases by the average accounts payable for the year. Vendors want to make sure they will be paid on time, so they often analyze the company’s payable turnover ratio.

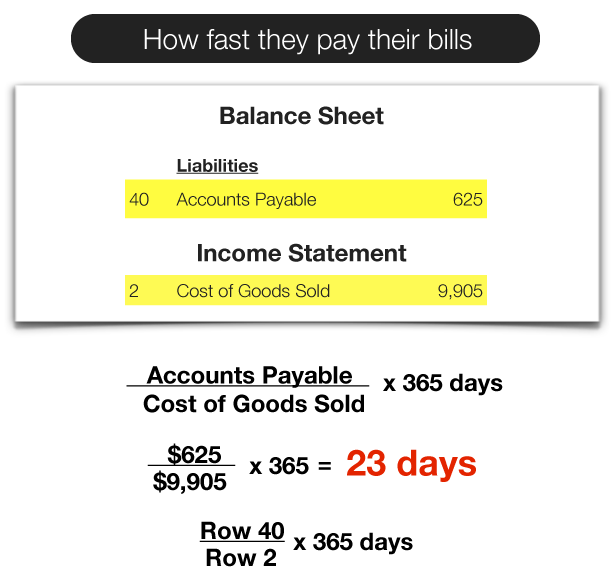

For instance, car dealerships and music stores often pay for their inventory with floor plan financing from their vendors. Vendors also use this ratio when they consider establishing a new line of credit or floor plan for a new customer. Companies that can pay off supplies frequently throughout the year indicate to creditor that they will be able to make regular interest and principle payments as well. This ratio helps creditors analyze the liquidity of a company by gauging how easily a company can pay off its current suppliers and vendors. In other words, the accounts payable turnover ratio is how many times a company can pay off its average accounts payable balance during the course of a year. The accounts payable turnover ratio is a liquidity ratio that shows a company’s ability to pay off its accounts payable by comparing net credit purchases to the average accounts payable during a period.

0 kommentar(er)

0 kommentar(er)